- Home

- debt

What is Debt Consolidation? and Some Traps to Avoid

Basically, consolidating debt is merging all your current debt into one. There are lots of approaches to accomplish this and it normally requires obtaining fresh signature loans. If you have bad credit rating that may cover all of your individual loans. As an alternative, you can do a number of expenses & a number of […]

Click to Read This ArticleTop Factors Looked at When Applying for a Loan with Poor Financial History

Getting a loan with a poor financial history is not always easy, but that doesn’t mean to say it’s impossible, and there are many lenders out there willing to lend to those with less than ideal credit history subject to certain restrictions and with generally higher fees. Here we’re going to have a look at […]

Click to Read This ArticleForget Bad Luck! Take Action to Repay Debts

Some people were extremely unlucky once the recession struck. The Collateralized Debt Obligation (CDO) crisis precipitated a recession that had many casualties. They ranged from traditional financial institutions to ordinary families where the closure of a local business resulted in unemployment and the inability to meet monthly expenses. Homes were lost and the credit scores […]

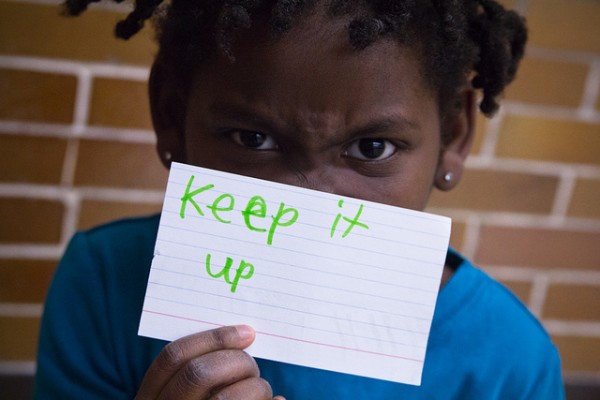

Click to Read This ArticleStaying Motivated While Taking Action on Debt

At some point or another you may have decided that you needed to start doing something about the debt that seems to keep accumulating. Most people who are in trouble with debt get to that point – but the problem is that after a month, or maybe two, it starts to feel like they’re just […]

Click to Read This ArticleWhy it is Necessary to be Aggressive when Dealing with Debt

Do you want to be free and clear of debt? Are you willing to do what it takes to achieve that goal? Most people tend to answer ‘yes’ to both those questions, but few people realize just how aggressive they will need to be to deal with their debt and steer themselves into a financially […]

Click to Read This ArticleHow to Manage Finances and Bust Debt

Are you feeling the pinch with your finances and starting to find that your credit card bill just seems to be getting bigger and bigger? If you’re struggling to keep yourself afloat while at the same time pay off student loans, mortgages, credit card bills and so on – it is high time that you […]

Click to Read This ArticleWant to Badly Get Out of Debt?

Many Americans live under the specter of overwhelming debt. According to the Federal Reserve Bank, consumer credit reporting agencies added bankruptcy notations to about 255,000 consumers’ records in the first quarter of 2015. Currently, Americans are nearly $12 trillion in debt. Credit card debt represents almost $900 billion of that, and student loans set American […]

Click to Read This Article6 Solid Tips to Win Your Battle Against Debt

Every individual owing debts has to manage his debts – irrespective of the amount of debt. If you owe a little amount of debt, you should pay it off by making regular payments so that it never goes out of control. In contrast, if your debt amount is quite high, you should put more effort […]

Click to Read This ArticleHow to Deal with Your Debt the Smart Way

Debt is one of those topics that people seldom talk about unless you are in dire financial straits. Being in debt isn’t always a bad thing, but if you can’t afford to pay your bills that’s when debt becomes a problem. It’s no secret that many people borrow above their means. Even after the economic […]

Click to Read This ArticleHow to Save Your Business from Debt

If your small business unit is having problems in meeting demands of the creditors, it is time you opt for debt relief suggestion. Every year, thousands of organizations become invalid and have to opt for debt relief. As an entrepreneur you must approach a professional and try to get your problems solved. The companies that […]

Click to Read This Article