How to Reduce Financial Stress

Nowadays, Australians are forced to cope with incredibly high levels of financial stress caused mainly by the rising costs of living. Everyday, it becomes harder and harder for the average Australian to maintain a comfortable lifestyle in the current economic situation.

A study led by business research leader CoreData, highlighted that 15% of the people interviewed were already using their savings and 10% were already running into debt to pay their bills. Also, about half claimed that they believe the situation will worsen and 40% of them were sure that they would not be doing any better next year. The research study emphasizes the idea that the Australian financial situation is sinking with every year that goes by. People are constantly looking to find efficient ways to get financial help, get a job and have a stable income.

Financial Counseling Australia

The FCA (Financial Counseling Australia) might be your way out of financial misery. Everybody has money issues and could use the services of competent counselors to help them deal with their situation. The FCA professionals are non-judgmental experts that can be of great assistance. Their free advice and step-by step guidance can be instrumental for people struggling to pay their bills and lead a normal lifestyle. As salaries are continuing to decrease FCA can show you how to balance your spending plan and cut costs so that you can survive this turbulent time.

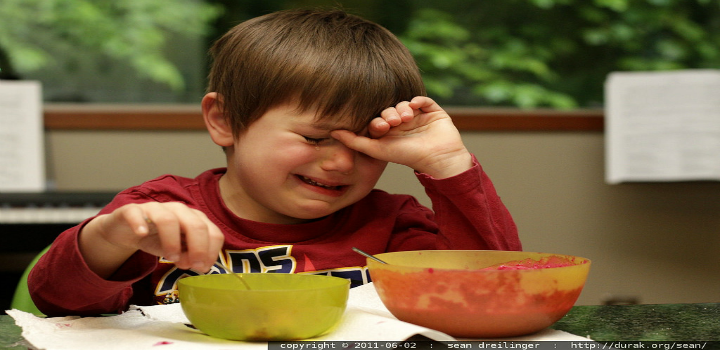

“I’m financially stressed I can hardly eat”. no dinner = no dessert = heartbreak – MG 1168.JPG by sean dreilinger, on Flickr. This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 3.0 Unported License.

Familiarize Yourself with Non-profits and Community-based Organizations

When financial issues really go south, the stress of not knowing who to turn to for help can be very overwhelming. Luckily in Australia there are many organizations that are setup to help those with emergency financial situations. In addition to other specialty finance companies who help with different Centrelink loans or personal finance options, there are programs like the Stepup initiative from the NAB and Good Shepard Microfinance which helps family with small, low interest personal loans.

Do It Yourself

There are hundreds of books available on budgeting for those that are not comfortable seeking professional advice. This information can walk you through a plan for saving money and organizing your debts so that all bills are paid on time and paid off quickly. Facing the reality, that without a proper plan, overspending will lead to bigger debt that at some point will be impossible to repay; doing it yourself may give you the strength to follow it through. For many people putting money aside is rather tricky. Hence, commit to putting yourself and your family in a better financial position. The secret is to start. Start small, put $10 aside each week and see how things go. In a month if you can put more away, good for you because this means you’re starting to abide by the rules that you set for yourself.

Your Home — Your Money Pit

Leaving aside the increased unemployment rates in Australia, the housing market is not doing so well either. CoreData indicated that from the 800 interviewed mortgage holders from the entire country, 25% admitted that they are trying their best to keep up with their monthly loan payments.

If your house is suffocating you with loan payments you cannot afford, do what is best for your health and happiness. Sell the house and move into something affordable. If this is not an option, find a roommate. A home is only as good as you feel when you are there. If you are frustrated and afraid each month when the mortgage bill is due, move on. The stress that this will remove from your life will make losing your home worthwhile.

You can reduce the stress of the current financial situation facing you. Develop a plan of action and then just do it. Pay yourself first and take control of your expenses. You can change your situation and make your days brighter by following the tips above. As with any economy, there are recessions and then there are times of prosperity. By seeking some assistance or doing it yourself you will be able to weather both times with finesse.