You Need These Financial Experts

Business owners should be careful about being the auteurs of the business world. When you try to exercise too much control over every process – either to fit your vision or simply to save money – you end up placing your business at risk. Here are some financial areas you can’t afford not to place into the hands of experts.

Bookkeeping

Bookkeeping is not the simple task many startup owners seem to think it is! If you’re not hiring someone who really knows when they’re doing when it comes to accounting, then you’re putting your business at risk. They’ll help you set up the correct ownership structure and ensure that you’re paying precisely as much tax as you need to. (A lot of businesses that forgo accountants end up underpaying or overpaying their taxes!) They’ll also help you design an accounting system that makes your financial reporting easy and accurate.

Investment

A lot of small businesses are looking at investments in assets outside of their business in order to help their profits grow instead of remaining stagnant in bank accounts. Of course, you need to ensure that you’re actually going to invest in things that will see a payday! While you can never guarantee such a payday (investing is basically a type of gambling, after all), you can turn to an investment expert to see what they would recommend you invest in as a business. Just remember to do some independent research while you’re at it, because investment experts are compensated via upfront commissions!

Debt collection

More businesses are owed money by customers or clients than you may think. Some business owners take the wrong route when it comes to getting the money back – sending threatening emails, calling the debtors frequently, that sort of thing. Others may be more complacent, afraid of seeming like some knee-smashing mobster threatening someone who may have dire financial worries. If you want to go about this correctly, you should have an experienced debt collection attorney. It’s a complex and sensitive issues that should probably be handled by someone with specialized experience in the area!

Auditing

Just because you have an accountant, it doesn’t mean you won’t have to deal with auditors who make sure that your business is valid and reliable in its payments to the tax authorities. “Getting audited” is a term that seems to strike fear into the heart of many business owners, but getting it over and done with can really be a massive weight off your shoulders. Consider hiring an external auditor so you can be assured – and assure others! – that you’re 100% compliant in all that you need to be.

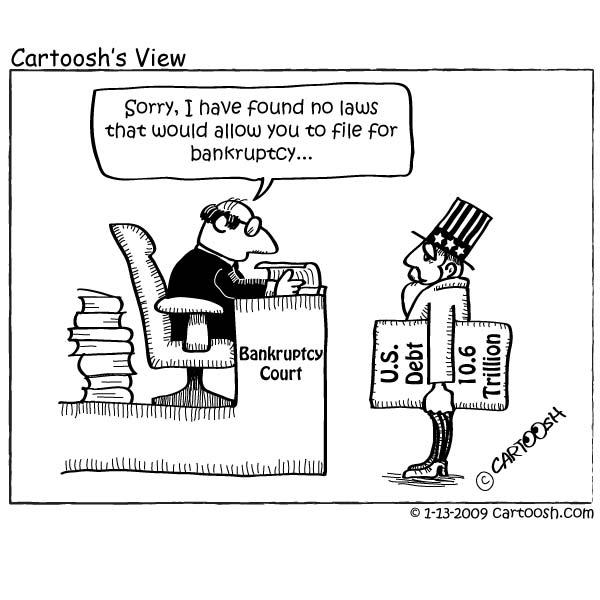

Bankruptcy

Another term that strikes fear into the hearts of business owners, though the fear is certainly much more understandable and warranted in this instance! Bankruptcy is a difficult process. This isn’t just because it’s legally and financially complex, though it’s certainly both of those things. It’s also because it’s an emotionally challenging time for the owner of the business in question! There are more ways to go about bankruptcy than you may think, so you may want to consider hiring a specialized bankruptcy attorney should you ever have the misfortune to have to go down this road.