The Pros and Cons of Mortgage Brokers

Shopping for a mortgage can be quite a complex procedure, especially if you have needs and requirements that are different to the norm. Finding the best rates and the most suitable mortgage can be tough; however a lot of people tend to use mortgage brokers.

Since the economic downturn, there has been questions over some brokers and questions have been asked whether or not they’re working in people’s best interests. That said, competent brokers can save you a fortune. So, let’s take a look at the pros and cons of using a mortgage broker.

Saves Hassle

Using a mortgage broker tends to cut out a lot of the faffing that you would otherwise have to deal with when looking for a mortgage. The alternative to brokers is checking comparison sites, contacting banks and looking through dozens of lenders on your own and then trying to make a decision. Brokers will push you towards a mortgage that suits your needs and will also push you away from dubious lenders.

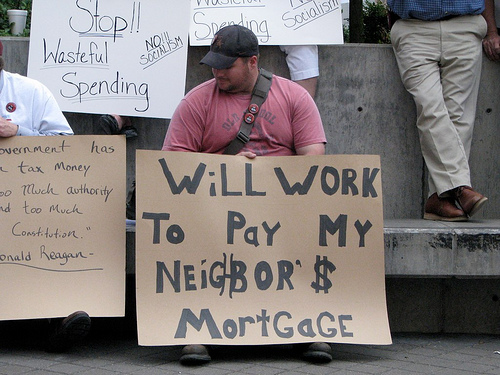

“Will Work To Pay My Neig(H)bor’$ Mortgage” by luna715, on Flickr. This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Suitability

Some brokers are given the provision of also being sort of gate keeper types. This means that they are given the task of finding financial institutions suitable to clients that will fit specific needs. This may mean that suitable people will be offered special rates from lenders for being preferable. This is often caused by the volume of business these people generate.

Fees

A lot of companies that work with lenders will be more than happy to offer you a cut rate on certain fees for origination, application and appraisal fees. This could save you hundreds and means your broker pays for themselves. They are the sort of people who can help buy your house for less.

Cons

There are also negatives to using a broker and finding a reputable broker is more than worth its salt. Sometimes brokers are given a higher commission for going with one lender over another and this means that there can be cheaper deals out there. In short, if you use a broker, still perform some research to get an idea.

paulbr75 / Pixabay

Guarantee

The broker will not always guarantee the estimate and often use the ‘good faith estimate’. This will mean that the broker believes rather than can certify that the estimate they’ve offered will be the final estimate. This may mean that changes can occur and the final estimate may be slightly different to the one you’re initially offered.

Lenders

Often you’ll also find that a lender does not work with a broker at all and this means that you may not be getting a complete idea of where the market is and what the best deals are. By working with a broker you may get better deals, but you may also not get a full view of the market. Statistics show that people who use brokers are more likely to default than direct lenders, hence the fact some avoid using brokers.

Mortgage brokers can be a great benefit and save you loads, but being aware of the downsides is no harm either and can really help you ensure you get the best deal there is.