Don’t Pay Too Much Tax as a UK Student

With tax often taking a large chunk out of your pay check every week or month, it’s certainly something that you want to be getting right. Recently, there have been a lot of students discovering that they have actually paid too much tax while working varied part-time hours. It’s not uncommon for people to leave university with several hundred pounds owed to them.

Just to clear things up, students do pay tax. It is a common misconception that they don’t, which is largely due to the fact that many don’t earn enough to be eligible to pay.

Working Overtime

The main problem is that while at university, many people tend to have part-time work that varies week by week in the hours worked. You might have a contract for 8, 16 or 20 hours for instance, but if it’s a busy time of year, or your employer is short staffed, you may well be called in for more than that. This is good in that you’ll earn some extra money, but sometimes, you might end up paying too much tax because of how the system works. This can be applicable for whatever you work as, whether you’re hotel staff or work in a bar.

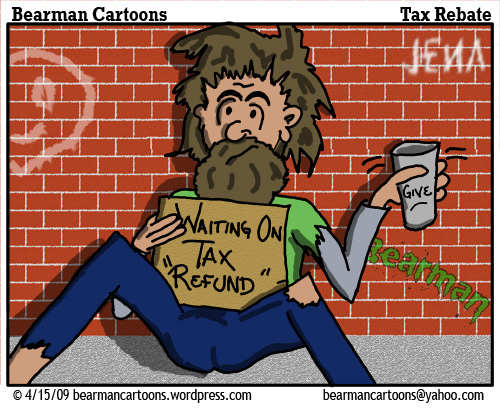

4 15 09 Bearman Cartoon Tax Rebate by Bearman2007, on Flickr. This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Unported License.

There is a yearly threshold when it comes to tax. You are only taxed when your earnings over the year exceed it. You can find out about the threshold and tax rates on the HMRC website. The problem with this however, is the PAYE tax is worked out on a monthly basis. This means that the yearly allowance is actually divided up into a monthly figure. Whenever you exceed this, you pay tax. As we’ve said already, it might be the case that some months you earn over the threshold, and sometimes below.

As a side note, if you are looking at business loans in Australia, the tax institute has a great article you can check out here.

The problem arises when, at the end of the year, you add up all of your earnings and haven’t actually earned over the taxable threshold. Simply, this means that you have paid too much tax, because you shouldn’t have lost any money on the months where you earned over the monthly allowance. It might also be the case that you did earn over the yearly threshold, but have still actually paid too much tax. This can be worked out by finding out how much you paid in total, and then seeing if this is more than the tax rate of whatever you earned over the threshold.

How to Get Your Tax Back

Fortunately, it isn’t overly difficult to reclaim your lost tax. You can either claim tax refund online, or do things yourself. The process involves writing to HMRC, backed up with all of the evidence you think is necessary. Overall, it’s likely that you’ll get the money back within six weeks. Many people do not even realize that they are owed tax, so it is always worth checking through your pay documents to make sure that you aren’t missing out.