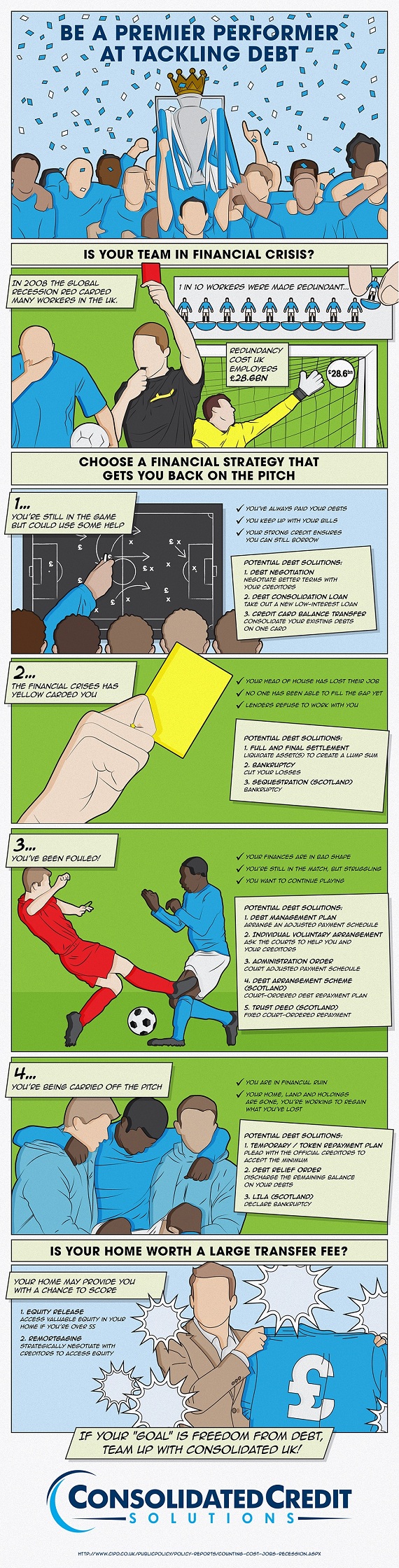

Soccer Debt

If you’re struggling with what seems like insurmountable debt, you’re not alone. Millions of people were adversely affected by the global recession. Even though the recession began in 2008, the economy has yet to fully recover, and unemployment soared to record highs — leaving many people without resources or recourse. With mortgages, school loans, medical bills and day-to-day living expenses continuing to build up, the absence of an income has an immediate impact. Compound interest on many of these debts can create a number that seems impossible to get out from under, even if you are still gainfully employed or are able to secure a new position.

macblack / Pixabay

Consider Other Options

What can you do to improve your situation? Before you leap to filing for bankruptcy, consider other options. While a Chapter 7 or 13 can help wipe away a good portion of the slate, not all loans or debt are covered by bankruptcy. Additionally, having a bankruptcy in your past can negatively impact your financial future. This infographic by Consolidated Credit provides several potential debt solutions that can help save your home and your credit score. For example, calling your creditors to work out a payment plan is a viable first step, and it often helps many people at least reduce the burden.