Using Market Correlation Matrix The Right Way

Living in a globalized world you can not expect financial markets being not integrated and operating on its own. They are rather joint and are moving along or in an inverse way – having turning points occurring at the same time. Despite your interest in some particular assets and currencies, like silver or GBP for example, it is still better to have a full overview and more fundamental analysis of many markets.

In doing so, you get a vast advantage over other investors, who concentrate on silver or gold only. Furthermore, to perform this analysis more efficiently, you need to try to assess the strength of the impact of the particular assets and respective equities. And that will make the picture wider showing the markets with greater potential at the particular moment.

In order to measure the impact you can make use of the linear correlation coefficient. Though keep in mind, that that sort of influence is not literal. It is not really telling which market influences which one, as rather common sense does it. That indicates that it is not the gold mining company which determines earnings and share prices by itself, but the price of gold is a starting point to push off.

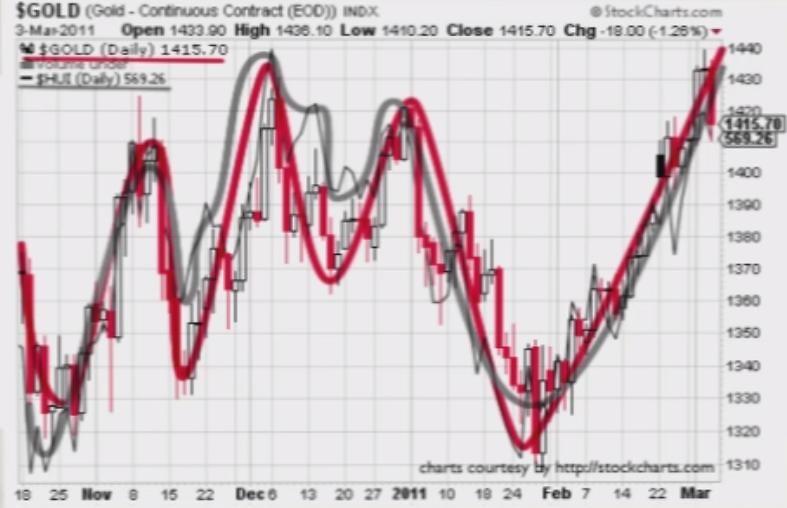

This number likely shows how much the markets moved together, not really expounding the reasons why it has happened. This kind of a certain relations does not change along with the shift in the prices, yet we can base our conclusions on the analysis of an individual market and use it to dissect other markets. For instance, if gold has moved opposite to the EUR index number recently, and there has just been seen a verified increasing trend in formation of the EUR Index chart, in that case it is likely that there will be a decline in gold. Despite the fact, that the situation in gold itself does not imply that on its own.

Correlation Coefficient

In order to understand and take the most advantage from the correlation matrix you need to understand what the correlation coefficient stands for. Basically, in Forex correlation is a statistical measure of how two particular currencies move in relation to each other. It is usually used in an advanced portfolio management. The correlation coefficient represents the number that depicts the degree of a linear relations between these two assets, showing that either they move along, backwards, or not related at all. With this number you are able to determine the strength of this relationships between FX currencies and use this infer information to analyze other assets as well.

Correlation coefficient ranges between -1 to 1 where:

-1 means that there is quite severe negative correlation between markets and they are moving in opposite directions

0 means that there is no movements of securities and therefore there is no correlation (they might be completely random)

1 means that there is a strong positive correlation and markets are moving along

A solitary number for the correlation would not be enough. And this is the reason why there exists such a fundamental tool like matrix of values for stock market investors.

Correlation Matrix

The correlation matrix substantially describes how closely the returns of the currencies in a portfolio are correlated displaying short, medium and long term interrelations. Investors are commonly advised to diverse their portfolios with assets having large spread correlations including currencies, precious metals and commodities. It is almost not possible for the coefficient to be exactly +1 or -1, as in real world no variable will have a stabilized relationship with another one at all times. If the coefficient is positive, a rise in the value of one variable will show a respective grow in the value of another one.

Forex specialists quite often disagree how currency correlation should be determined, as correlation coefficient may have several disadvantages:

- It is valid for linear dependencies, as straight-line relations between two assets are rarely observed.

- It captures first two moments of the relationship, where 0 does not inevitably mean that there is no relations at all.

- Correlation is changing over time. Even if gold and oil have a long term correlation, it is still changeable over shorter periods of time.

Do not use the matrix to calculate the exact sizes of one’s positions or to assess the size of the position that one would want to limit. Most statistical coefficients are partial, but they do not pose a serious menace as long as you use the outcomes for comparison of assets. Use the correlation analysis to find important connections between the markets and employ them in conjunction with other types of Forex analysis, which would increase the productivity in performance and consequently increase the returns.