Buying a home can be a very exciting and stressful time in a person’s life. There are a number of things that have to happen in order to get the right results from their home buying experience. Finding the right mortgage takes some time and effort on the part of the prospective buyer. Finding the right lender is the first thing that a prospective buyer has to do. Another important thing that a buyer must do is to find a way to boost their credit a bit for the loan. Here are a few things to consider when trying to give your credit score a bit of a boost.

Paying Off Some Credit Cards

One of the first things that a person will need to do when trying to boost their credit score is to pay off their credit card balances. Having too many credit cards on a credit report may affect the score negatively. By taking the time to find out what you owe and pay it, you will be able to get the right results and get the best loans in an area.

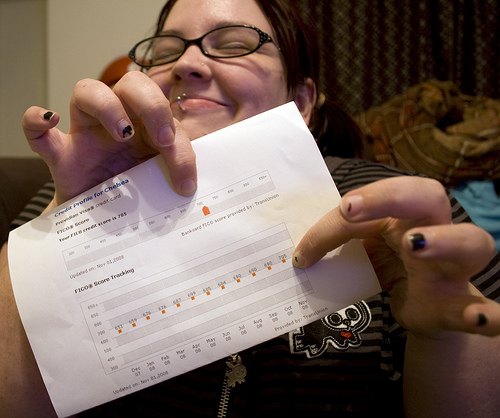

233 by me and the sysop, on Flickr. This work is licensed under a Creative Commons Attribution-NoDerivs 2.0 Generic License.

Check Credit Report for Errors

The next thing that a person needs to do when trying to boost a credit score is to check their credit report to make sure there are no errors. Having too many errors or false reporting on a credit account can really affect a person’s ability to get a home loan. By having a look at your credit report, you will be able to get all of the errors off your report. The time and effort that goes into this process will be more than worth it in the end when you are able to get the right loan for your new home.

Do Not Apply for Any New Credit

Another very important thing you need to consider when trying to boost your credit is not applying for any new lines of credit. By eliminating the inquiries on your credit report, you will be able to have a higher score. The last thing you want to do is apply too much credit due to the negative impact it can have. By taking the time to get this problem fixed, you will be able to get the best mortgage loan possible for your credit situation.

By using the team at tribecca.ca, you will be able to get the right loans for the home you need. They have been in the business for a number of years and can offer the help a person needs.