Simple Ways To Prevent Overspending

Be honest. Are you guilty of spending too much? If you are, you’re certainly not alone. In this day and age, it’s all too easy to try and live beyond your financial means. The trouble is that weeks of overspending leads to months and years, and before you know it, your finances are in a mess. If you’re a self-confessed over-spender, here are some helpful hacks to help you stop splurging.

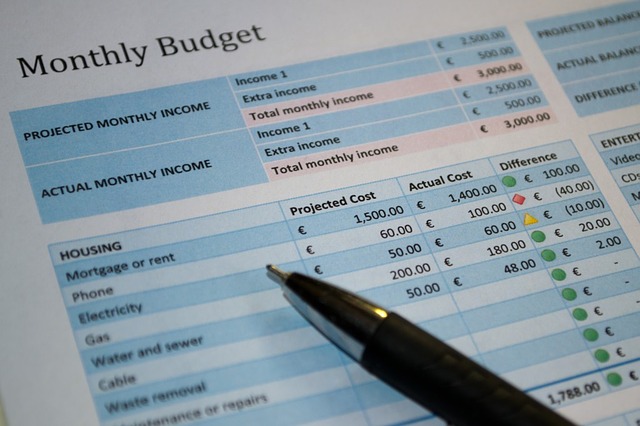

Budgeting

The latest research suggests that almost two-thirds of Americans don’t budget. Budgeting may not seem like the most riveting use of your time, but it’s such a simple and useful way to keep track of what you’re spending and what you’re saving. It’s so easy to lose track of what’s going on when you’re spending $10 here and there without really thinking about it. You may have an idea of how much money you’ve got in your account, but when you check your balance, are you used to seeing a figure that’s completely different? If so, it’s well worth devoting half an hour to drawing up a budget at the start of every week or month. Write down every expense you expect to incur that week or month, and update the budget as you go, so that you’re always aware of where you are, and how much you can spend.

Image via https://pixabay.com/en/accounting-bill-billing-finance-57284/

Shopping around

When was the last time you checked out the best prices on TV, broadband or cellphone contracts? Do you renew your insurance policies without even thinking about getting prices from other providers? Have you taken out a loan without considering all your options? Whatever you intend to buy, renew or borrow, it’s always beneficial to shop around. From finding the best place to get a discount auto loan to working out which credit card is best for you or how much you could save by switching health insurance provider, it pays to get online and compare prices. The Internet can give you a set of tailored results in minutes, and you could end up saving a small fortune each month.

Image sourced from https://www.pexels.com/photo/ecommerce-fashion-leather-shoes-online-shopping-160030/

Checking your balance

One of the most common causes of overspending is not checking your balance frequently enough. We’ve all been in the situation where we regret buying something because we’ve got a lot less money than we thought we had. You don’t need to log in three times a day, every day, but make sure you’re aware of how your account is looking. This applies to your current account, as well as your credit card balances. Even small payments here and there can add up quickly. Online banking is really useful because it enables you to check your balances on the go.

Image credit https://pixabay.com/en/photos/bank%20note/

Most of us have been in the situation where we’ve overspent before. Sometimes, unexpected expenses come along, or we get a bit carried away. The trouble is that it’ easy to get used to overspending. If you’re prone to going over your overdraft limit or you rarely have enough money to make it to payday, now is the time to start being more diligent. Stick to a budget, check your balances, and shop around to get the best deals.