Making Money from Share Trading

There are a number of different investment options for those looking to invest. While the share market can seem a bit daunting to the uninitiated, trading in shares can be a great way to invest. If you plan on share trading in Australia though, it’s important to do your homework.

Following Patterns

What goes up must come down, as the saying goes, and this applies to share markets as much as anywhere else. What happens with war, recession and oil price rises, the share market can be a volatile place.

However, there are patterns that emerge, and if history is to be any example, we can see the share market moves in cycles. Just take the 1987 Share Market Crash, the 1997 Asian Crisis, the 2000 Tech Wreck or September 11th in 2001. Crisis is followed by recovery.

Research

If you plan on making money from shares, you will need to put in the research. Think about it like this, when you buy shares in a company, you are investing in that company. You wouldn’t want to invest in a company that you know nothing about.

Research the company you want to invest in, research trends in the share market, and find out more about how online trading works. Once you have decided what to invest in, keep a close eye on changes in the market, and what the company is doing.

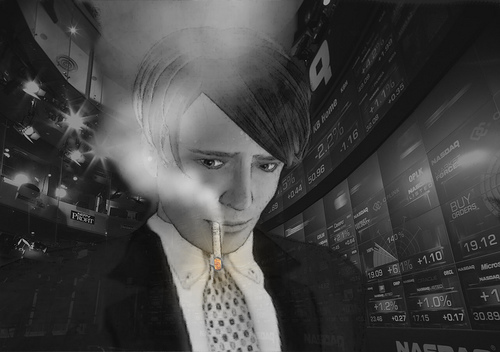

Market Crash by Morris Vig, on Flickr. This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 3.0 Unported License.

Why Invest in Shares?

If you have money to invest, it’s important to understand your options. Perhaps a term deposit or a high interest savings account would be a good choice, or perhaps investing in super or property would work better for you.

However, investing in shares can be profitable, as long as you know what you’re doing, and you have some luck and some patience. You can make money on shares from capital gains and from dividends, and if you make the right choices, it could be very lucrative.

It’s also worthwhile thinking about inflation. If you decide to keep your money in a savings account for example, you would need to earn at least 3.5% interest in order to make up for the money you lose through tax and inflation. Perhaps share trading could offer you more.

Making Money

As mentioned earlier, there are two ways to make money from investing in shares. Dividends are paid out to share holders by some – but not all – companies, and can be used by the investor to buy more shares, or to use as he likes. Dividends will usually rise and fall depending on the success of the company.

Capital gains – also known as capital appreciation – is the profit an investor makes after buying and selling shares. This is where the motto of “buy low, sell high” comes in. Making money from shares in this way will depend on the user’s timing, and knowledge of the company and the share market.

skeeze / Pixabay

Getting Started

If you are thinking about investing in shares, you will need to consider a number of angles. What companies to invest in, how much to invest in each company, and how much to invest in total. Do your research and speak to a professional adviser if required.

When trading in shares, it can be a good idea to only invest money that you will not need in the next five years, and to keep a stash of savings elsewhere in a high interest savings account. This could allow you to ride out market ups and downs, and have an emergency fund if needed.