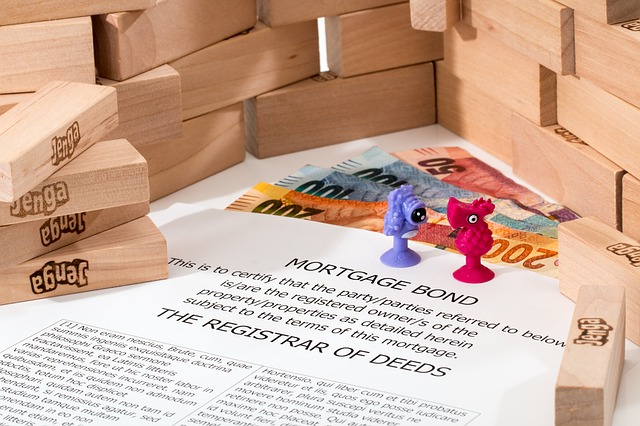

From Millennial To Homeowner In 5 Steps

There are so many articles and news stories in the media these days about just how hard it is for millennials to get on the property ladder. And it’s true that a difficult economy and stagnant wages have made it much more difficult for young people to buy their very first property. But is it really impossible? If you follow these five important steps, you will find that it is actually a lot easier to buy a house than you might have originally thought.

Start Saving Early

There is no way you will be able to get a mortgage without a deposit, so you should start saving up for one as soon as possible. Even if you are only putting away $50 a month towards your deposit, you are still making progress. Rather than simply putting these savings into a regular bank account, you should look for a high-interest bank account so that you can build up as much interest as possible.

Join A Government Scheme

The current government understands just how difficult it is for young people to get a mortgage these days, and have created some schemes to help make it easier. There are now some new homes that are built specifically for first-time buyers. Plus, there are now some options to rent to buy – after a few years of paying rent, the house will be available for you to buy at a reasonable price.

Look For A Specialist Mortgage

Most of the traditional mortgage providers won’t be so keen to lend money to young home buyers as they might be seen as too much of a risk. However, there are now lots of providers, such as Enness Mortgages, who specialize in 100% mortgages and ones for freelancers and the self-employed. If you speak to these types of providers, you will find that it could actually be quite easy to get your hands on your very own home!

Research Neighborhoods

No matter which city you are looking to buy in, some of its neighborhoods will be a lot cheaper than others. You should do your homework into each of the different neighborhoods to figure out which ones are within your budget. There’s no point looking around the expensive areas as it will only waste a lot of time.

Think About A Guarantor

If you go through the above four steps and still find that it is proving to be difficult to persuade a provider sign off on a mortgage for you, you should try and find a guarantor. This is someone who co-signs your mortgage with you. If you are ever unable to meet your monthly repayments, then the guarantor is responsible for taking over the payments. Most millennials get their parents to be their guarantor and, if they are ever required to pay off the mortgage for a few months, they will be easy to pay back.

As you can see, getting a mortgage as a millennial might not be so difficult after all!