Investors as a group tend to walk a bit of a tightrope, balancing the amount of return they must have on their investments against the risk they are willing to assume. Some investments have the potential for realizing either a significant return or a massive loss, while others seem to plod along, rising and falling according to the trend of the market as a whole. Whether one chooses to retain the services of a professional fund manager to analyse market trends and make investment decisions (active management) or retain a firm that automates the decision-making process depends greatly upon the investor’s expected returns and acceptable risk level.

Historically, active managed funds have far outnumbered the passive, but that ratio has trended quite differently in the last few years, as exchange traded funds, or ETFs, have become more common. While there are many highly experienced active fund managers, the majority have failed to perform at a level where investors’ returns are higher than overall market trends. Passive fund management, however has more closely followed overall market performance, thus outperforming most active funds.

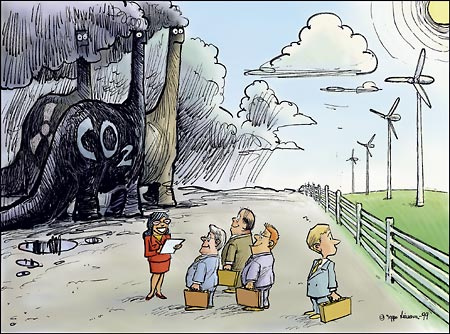

Ethical Investor by Seppo Leinonen, on Flickr. This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 2.0 Generic License.

Passive funds, on the other hand, rely upon computer analysis of market events and trends, rather than human analysis performed by active fund managers. Responses are based in statistical algorithms more than intuition and experience, and are therefore more immediately responsive to market shifts. And since the passive fund management process doesn’t rely so heavily upon highly experienced (and highly-paid) managers, the actual management costs of passive fund management is far lower.

It would seem therefore that the logical choice for the average investor would be to lean heavily toward passive fund management as the preferred investment method. It may offer a lower likelihood of significant gains, but it has also presented a lower element of risk to the investor than the majority of active fund management efforts, not to mention the lower associated management fees. Some of the active management fund managers have lowered their fees in order to remain competitive with the less labor and expertise-intensive passive managers, but many investors are seeing that as too little, too late, and the active management industry is facing the potential of obsolescence for all but the most return-motivated and risk accepting investors. This is evidenced by the fact that a significant number of large institutional investors are now placing the bulk of their investments – up to 70% in some cases – in passive funds.

Recent history of unsavory and even fraudulent behaviors on the part of some of the most respected active fund managers also lends incentive to move investments to passive fund management companies. Even the American billionaire Warren Buffet, who has exemplified the wealth potential possible with astute, active fund management, has begun focusing increasingly upon passive management vehicles, and intends to leave his wife’s economic well-being primarily in a fund that is managed according to market events, rather than fund managers’ experience and intuition. And when Buffet makes such a decision, you can be pretty well assured that it is a good one.