College can be expensive, so it’s important to have a basic understanding of different types of student loans before you borrow. That way, you can feel more in control of your financial standing, maximize the amount of federal aid you receive and minimize the amount you have to repay down the line. Whether you’re enrolling in college for the first time or are a seasoned student, these six options will typically be your best bet for financial assistance in further education.

Stafford Loans

These are the most common federal education loans students receive that are available for U.S. citizens as well as eligible non-citizens who are enrolled at least part time in an eligible degree or certificate program at an accredited university, college, or vocational facility. Students can borrow up to $23,000 over the course of their higher education, but the Stafford loan is not available to graduate students. Repayment won’t begin for Stafford loans until six months after borrowers graduate, withdraw, or drop below half-time enrollment, giving a decent amount of time to prepare financially as much as is possible.

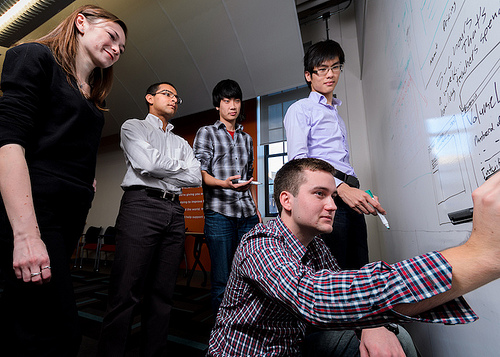

Education Changemakers: Business Models Matter by MaRS Discovery District, on Flickr. This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.

Perkins Loans

These are low-interest federal loans administered by the schools themselves for students who demonstrate exceptional financial need. Typically, a Perkins loan will mean more money for the recipient than a Stafford loan. Unlike Stafford loans, Perkins loans are available to undergraduate and graduate students who are enrolled at least part time in an eligible degree or certificate program and allow students to borrow up to $27,500 for undergraduate students and up to $60,000 for graduate students with repayment not required until nine months after a borrower graduates, withdraws, or falls below part-time enrollment.

PLUS Loans

Taken out by dependent students’ parents or by graduate students, these loans can cover expenses not met by other aid. These student loans are not based on financial need, and borrowers must have credit in good standing to receive assistance. Those who take advantage of PLUS loans can borrow up to the total cost of attendance at the school minus aid received, and PLUS loans won’t need to be repaid until 10 years after acceptance.

Consolidation Loans

If you need a fixed interest rate and long-term assistance, these loans combine one or more preexisting loans into one new one. These are available for borrowers with one or more eligible federal student loans, with no loan limits and provides students up to 30 years to pay off. Consolidation loans are a good idea for students with high interest rates looking to secure lower, more stable rates with a longer period of time to pay off.

Institutional Loans

These are non-federal aid schools loan their students. These vary for a variety of reasons since your service provider may be your school or agency hired by your school, and repayment options will vary, as will interest rates. They are similar to private loans or “alternative loans” and it’s important to contact your school if you’re considering an institutional loan to learn more about the terms of these loans.

Private and State Loans

Private loans are not funded or otherwise processed by the federal government and do not have many of the repayment and deferment options that are available with federal loans. These can be an important option if the borrower doesn’t qualify for other forms of aid, but because of this, they vary widely with interest rates, payment structures and length of time to repay.