When it comes to financial planning, investing in a life insurance policy is a great way to ensure your family’s financial stability in the event of your death. A life insurance policy allows you to choose the amount of money you would like to be awarded to a beneficiary you named in the policy, at the time of your death. The policy remains in effect until you die and you will make monthly payments (known as premiums) on the policy so long as it is in force.

The premium amount will vary, based on a number of factors such as your age, your coverage amounts and the type of policy you invested in. Perhaps one of the most attractive things about life insurance is that there are no stipulations on what the insurance money can be used for, once it has been awarded to your beneficiary.

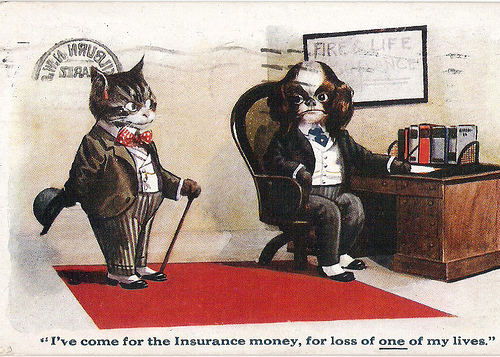

insured lives by lolaleeloo2, on Flickr. This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Term or Perm?

There are two major types of life insurance policies – term life insurance and permanent life insurance. Term life insurance provides coverage during a pre-determined time frame of up to twenty years. You are covered for that time frame as long as you pay your premiums, but if you live longer than your policy lasts, it will have to be renewed, if you want to continue coverage. Term life insurance generally has lower premiums than permanent life insurance because it does not accumulate cash value over time.

Permanent life insurance policies do not expire and remain in effect as long as you pay your premiums. They do build cash value over time and can be cashed in on at a later date. Permanent life insurance policies are more expensive than term life insurance policies because of the cash value factor and because they provide other flexible options as well. Find out difference in term and permanent life insurance in 90 seconds here.

How Much Cover?

When it comes to deciding just how much life insurance one needs, many people are tempted to purchase any amount that sounds good to them at the time – which is often a serious and costly mistake. There is a specific formula that needs to be followed in order to be sure your family is left with enough funds to continue the quality of life as they know it now. That formula is based on factors life your current income, current savings account balances, your debts, your retirement benefits and more. You can use this calculator to get an idea of how much cover do you need.

Start Young

As with any other insurance policy, the time to invest in a life insurance policy is before you need it. While you may think it makes more sense to wait until you are older and approaching the end of life to invest in life insurance, you may be setting yourself up to pay astronomically high premiums. Not only is age a factor in the cost of premiums, but so are health conditions and ailments that come into play with advanced age. If possible, lock in the lowest premium possible by purchasing a life insurance policy when you are young for the amount of coverage you will need when you are older.

If you are wondering which type of life insurance would be best for you and your family, contact a registered insurance provider to discuss your concerns. They can help you find the right policy with your desired coverage amounts at a price that is within your budget.